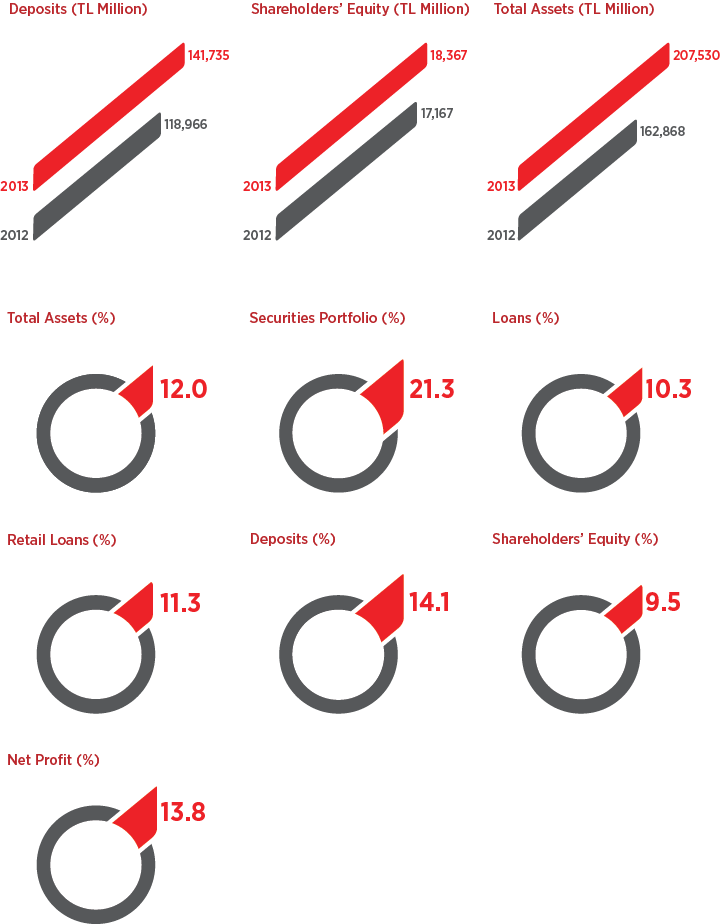

Financial Indicators

(TL Million) |

2013 |

2012 |

Change (%) |

|---|---|---|---|

|

|

|

|

Total Assets |

207,530 |

162,868 |

27 |

Liquid Assets and Banks |

29,067 |

22,647 |

28 |

Securities Portfolio |

62,798 |

65,469 |

-4 |

Loans |

111,048 |

71,426 |

55 |

Deposits |

141,735 |

118,966 |

19 |

Shareholders’ Equity |

18,367 |

17,167 |

7 |

Interest Income |

14,370 |

14,811 |

-3 |

Interest Expense |

6,631 |

7,910 |

-16 |

Pretax Profit |

4,379 |

3,505 |

25 |

Net Profit/Loss |

3,330 |

2,650 |

26 |

Ziraat Bank Shareholding Structure

The Undersecretariat of the Treasury of the Republic of Turkey is the sole owner of Ziraat Bank. The Chairman and Members of the Board of Directors, Members of the Board of Auditors, the General Manager and Assistant General Managers do not hold shares in the Bank.