2017 Annual Report

- INTRODUCTION

- Our Vision-Our Mission-Our Strategies

- Corporate Profile

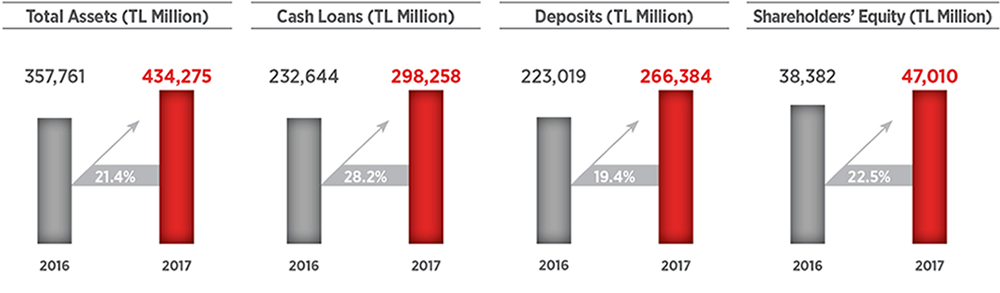

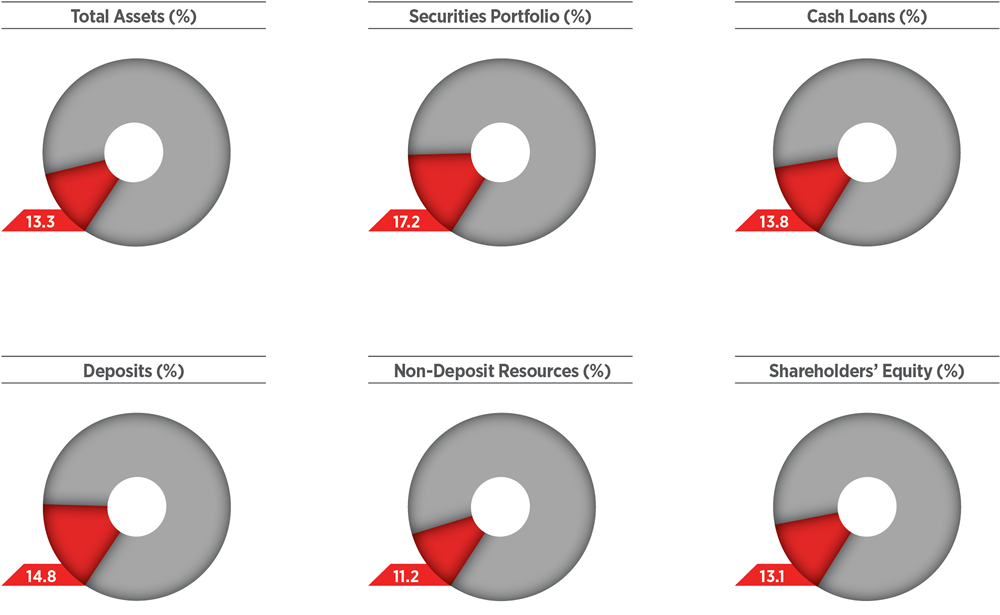

- Financial Indicators

- Continuing to Generate Value with the Passion to Offer More Than Banking

- Milestones in the History of Ziraat Bank

- Chairman of the Board’s Message

- CEO’s Message

- Macroeconomic Outlook

- An Assessment of 2017: Strategies, Developments and Targets for the Future

- Social Responsibility and Public Relations

- Ziraat Bank’s Subsidiaries in 2017

- Changes in the Articles of Association in 2017

- The Report on Compliance of Annual Report

- MANAGEMENT AND CORPORATE GOVERNANCE PRACTICES

- Ziraat Bank Board of Directors

- Ziraat Bank Senior Management

- Summary Report - Board of Directors

- Human Resources Practices

- Information on the Activities of Committees

- Attendance by the Members of the Board of Directors and of the Audit Committee in the Meetings Held During the Reporting Period

- Related Party Transactions

- Companies from which Support Services are Obtained

- FINANCIAL INFORMATION AND RISK MANAGEMENT

- Audit Committee’s Assessment of the Operation of the Internal Audit, Internal Control, and Risk Management Systems

- Ziraat Bank’s Financial Standing, Profitability and Solvency

- Ratios

- Information about Risk Management Policies and Activities According to Type of Risk

- 31 December 2013-31 December 2017 Summary Balance Sheet and Income Statement

- Credit Ratings Assigned By Rating Agencies

- Publicly Announced Unconsolidated Financial Statements together with Independent Auditor’s Report at 31 December 2017

- Publicly Announced Consolidated Financial Statements together with Independent Auditor’s Report at 31 December 2017

- DIRECTORY