Ziraat Bank and Sustainability

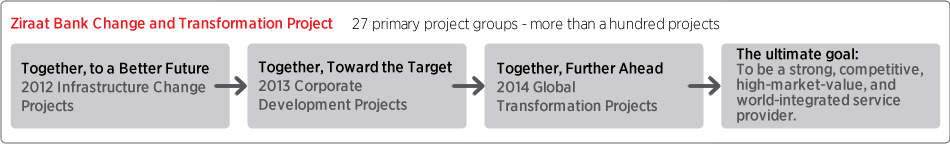

In 2013 Ziraat Bank completed the infrastructure transformation projects that it initiated in 2012 under the slogan “Together, to a Better Future” with the aim of taking the unrivaled store of knowledge and experience that it has built up in the course of its corporate history into the future.

Ziraat Bank’s sustainability objective is, through the corporate sustainable practices that it introduces in line with its Sustainability Policy, to further enhance both the Bank’s strong position in its home market and its global competitive strength by increasing the leverage effects of its Change & Transformation Project in the medium and long term first at Ziraat Bank and then throughout all of its subsidiaries.

In 2013 Ziraat Bank completed the infrastructure transformation projects that it initiated in 2012 under the slogan “Together, to a Better Future” with the aim of taking the unrivaled store of knowledge and experience that it has built up in the course of its corporate history into the future. The fundamental goal of the Change & Transformation Project is to grow while remaining sustainably profitable and productive.

However change and transformation are never-ending journey. In order to take the successes achieved under this project to the next level, in 2013 Ziraat Bank continued its corporate development projects under the slogan “Together, Toward the Target”.

Carried out with the same excitement and with a dynamic approach at Ziraat Bank itself and among its international subsidiaries, these projects were again financed out of the Bank’s internal resources in 2013, just as they were in 2012.

Each one unique but conducted in coordination with one another, there are more than a hundred such projects. They are organized into 27 primary project groups and rooted in six fundamental principles.

1. One-On-One Customer Relationship Management

Customers are among Ziraat Bank’s most precious assets. Establishing a sustainable, added-value-creating relationship with each customer is one of the Bank’s most important objectives.

The principle of changing from a Product/Customer-Based Approach” to a “Bank Customer-Based Approach” that was identified in 2012 was taken to the next level in 2013 by replacing the concept of “bank customer” with that of “Ziraat customer”. Ziraat Bank’s infrastructure was further developed in 2013 both structurally and systematically so as to better listen to and understand customers’ financial needs and to address them correctly.

Seeking to be a strong player in global markets in line with the Change & Transformation Project, Ziraat Bank is committed both to pursuing its ambition to author best practices in customer relationship management.

2. Institutionalized Appetite for Risk

The fundamental criteria to which Ziraat Bank adheres for the effective management of credit risk consist of:

The decision support systems that were put in place in 2012 continued to be improved with the addition of new features in 2013. New practices concerning effective loan monitoring and collections were also introduced.

3. Effective Information Technology and Operational Infrastructure

2013 was a year in which Ziraat Bank brought to completion a number of major infrastructure projects. Efforts to expand the scope of automation in branches, regional departments, and headquarters units continued with no loss of momentum. In line with this, IT infrastructure and IT hardware replacements initiated to make more effective use of technology also continued, IT equipment that had reached the end of its service life was replaced, and local area network and IP PBX projects also neared completion.

One of the most important of the Bank’s goals in 2013 was to turn its branches into places that focus on customers’ financial needs while also reducing branch workloads. To achieve this, the set of transactions performed directly by the Operations Center (which opened in 2012) was expanded as were efforts to manage branches’ operational workloads. Process centralization and system improvements carried out in 2012 and 2013 made it possible for 2,207 members of the Bank’s workforce to focus their attentions on addressing customers’ needs.

4. Objective and Transparent Human Resources Management

Ziraat Bank’s Human Resources Policy is informed by a structure that places people at its center. An important element of this policy is that employees should benefit from the job satisfaction that arises from working happily in positions befitting their abilities.

In 2012 Ziraat Bank changed from a title-based, largely vertical organizational structure to a more horizontal structure based on job descriptions. This process continued in 2013 with the introduction of practices enabling employees to advance in their job positions according to their abilities and competencies and also to be promoted based on their testing performance.

In this way about half of all employees advanced to the next higher level/position. The purview of the Individual Performance Evaluation System, which evaluates employees on the basis of their performance, was expanded to include branch personnel as well in 2013.

As required by Ziraat Bank’s principle of transparency, employees are involved in and made aware of all innovations in issues affected by the Change & Transformation Project. In 2012 a variety of in-house communication channels were opened in order to keep personnel informed about changes being made under that project.

5. Robust Equity Resources

Profits, which are the most important element of a company’s equity, are retained by Ziraat Bank as a way of further strengthening the Bank’s equity resources. In keeping with the principle that rational bigness is better than just bigness, Ziraat Bank seeks to achieve sustainable profitability and growth and in 2013 it continued its efforts to do so. In order to be a bank that creates adds more value to the national economy by financing the real sector, Ziraat Bank reduced the share of its balance-sheet assets consisting of real estate properties while also increasing both the share of loans and the percentage of deposits being lent out. Efforts were made to diversify non-deposit resources in order to lower the Bank’s liability costs. This included having recourse to syndicated loans and to bank bond and bill issuances.

6. Integrated Subsidiary & Affiliate Management

An important goal for Ziraat Bank in 2013, summed up in the change of focus from one of “Bank Customer” to one of “Ziraat Customer”, was to ensure that all of its customers’ financial needs can be addressed entirely from within the Ziraat Finance Group.

Since the second quarter of 2013, the Bank has been carrying out projects aimed at expanding the organizational capabilities of its subsidiaries and international branches.

The projects being undertaken as part of the changeover to a Ziraat Customer Business Model are concerned with such issues as organizational structure revisions, customer & branch segmentation, credit evaluation model design, improvements in HR practices, basic banking software and application upgrades, and process management. The goal is to bring about the Ziraat Finance Group’s global transformation by completing all of these projects before the end of 2014.

For more detailed information about the Ziraat Bank Change & Transformation Project, please see pages 14-15 of our 2013 Annual Report.

http://www.ziraatbank.com.tr/en/InvestorRelations/Documents/AnnualReports/AnnualReports.pdf

Ziraat Bank’s Sustainability Policy3

Our sustainability vision

To use the unrivaled experience and knowledge that we have built up over a century and a half for the benefit of the economy, the environment, and the community; to produce enduring value for our stakeholders; to be a globally-competitive bank through the principles of sustainable profitability and efficiency.

Our sustainability goal

To further develop both the Bank’s strong position in the domestic market and its global competitive strength by increasing the medium- and long-term leverage effect of the Change and Transformation Project through corporate sustainability practices to be implemented under this Sustainability Policy.

Our sustainability approach

Our sustainability approach is shaped in light of our responsibilities as a financial services provider, of our obligations to the environment and the community, and of our duties as an employer.

Taking the foregoing fundamental tenets as our point of departure, we are focused on promoting, developing, and maintaining sustainability throughout our value chain.

Our sustainability structure

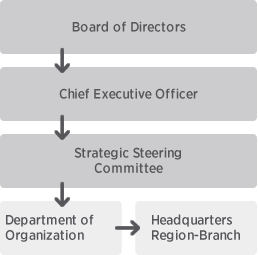

Our sustainability plan is structured under the aegis of the Ziraat Bank Board of Directors. Its implementation is informed by a straightforward and effective organizational structure.

Our dialogue with stakeholders

Ziraat Bank’s long-term success depends on its stakeholders’ trust and continued goodwill. The sustainability projects we undertake play a role in further strengthening stakeholder confidence and loyalty.

Ziraat Bank and the environment

As one of the biggest employers in the Turkish banking industry and the hub of its most extensive physical service network, our goals are to curb our direct and indirect environmental impact, to effectively manage that impact by means of appropriate strategies and technologies, and to constantly improve our performance in this direction. To this end:

Ziraat Bank and the community

As a company which employs about 25 thousand people, which helps millions of individuals to make their dreams come true, and which supplies financial products and services at locations all over the country, in more than 400 of which it is the only such service provider, Ziraat Bank contributes to the community in many different ways. We continue to create value for society and to take multidimensional approaches in support of social development through efforts capable of maximizing their socially beneficial impact.

Our products and services

In the processes of satisfying evolving customer needs and expectations, of supplying the right product and service to the right customer at the right time, and of productively exploiting new business opportunities presented by markets, Ziraat Bank always takes environmental and social issues into account as well. To this end:

Summing up

Having been proving that it is more than just a bank for a hundred and fifty years, Ziraat Bank’s innate compatibility with sustainability principles springs from its passion to create value for the country and for the world.

Given the general framework encompassing its sustainability policy, Ziraat Bank is committed to pursuing and maintaining sustainably profitable and efficient growth as a competitive, strong, high-market-value, and globally-integrated bank.

Constantly improving our Bank’s sustainability performance in keeping with the principles of transparency, accountability, compliance with the law, ethical behavior, and risk management, we remain on course as a financial institution that is more than a bank in the area of sustainability as well

3) The Bank’s Sustainability Policy was approved by the Board of Directors on 30 September 2014.

Ziraat Bank’s objectives in the period ahead are to accelerate its sustainability performance by identifying those who are responsible for sustainability issues throughout the entire organization, improving sustainability-related processes, and preparing job descriptions for those personnel charged with sustainability matters.

Ziraat Bank’s sustainability structure

Sustainability issues at Ziraat Bank are coordinated by the Strategic Guidance Committee. At the time that this report was being prepared for publication, a changeover was made to a streamlined and activities-focused Sustainability Policy which had been approved by the Ziraat Bank Board of Directors and which had been publicly disclosed on the Bank’s website at www.ziraatbank.com.tr.

Sustainability-related activities at Ziraat Bank are conducted with the knowledge and oversight of the Board of Directors. Sustainability projects that may be undertaken at the Bank are considered and dealt with by the Strategic Guidance Committee.

The officer with the most senior decision-making authority with respect to the day-to-day execution of sustainability practices is the Ziraat Bank General Manager. The Ziraat Bank Organization Department is responsible for the conduct of sustainability practices in the context of the day-to-day business model.

Ziraat Bank’s objectives in the period ahead are to accelerate its sustainability performance by identifying those who are responsible for sustainability issues throughout the entire organization, improving sustainability-related processes, and preparing job descriptions for those personnel charged with sustainability matters.

Stakeholders: Dialogue and Priorities

Shareholders, employees, customers, and suppliers make up Ziraat Bank’s core stakeholder group. The Bank engages in interactive communication and cooperation with these stakeholders in the conduct of its activities and a large part of such communication takes place in the context of day-to-day business. This is an extremely valuable platform insofar as it enables Ziraat Bank to correctly understand and act upon its stakeholders’ wishes and expectations.

In addition to this core stakeholder group, Ziraat Bank also maintains close communication with other stakeholders, which consist of regulatory agencies, international banks and investors, media, professional bodies and associations, and the public at large.

|

Stakeholder group |

Communication frequency |

Communication channels |

|---|---|---|---|

CORE STAKEHOLDERS |

Employees |

Day-to-day job performance |

Hiring processes, personnel training programs, performance evaluation processes, in-house communication, discussions and meetings with supervisors. |

Customers |

Round-the-clock service provision |

Ziraat Bank branches and alternative delivery channels (ATMs, internet banking, mobile banking, call center and other ADCs), customer representatives, customer visits. |

|

Suppliers |

Day-to-day conduct of business |

Procurements of all materials and services from sources external to Ziraat Bank. |

|

Shareholder |

General meetings and on other occasions when necessary |

Annual general meetings. Ziraat Bank also engages in a variety of public disclosure activities through its investor relations unit such as annual reports, other presentations, and announcements made to the Public Disclosure Platform. |

|

OTHER STAKEHOLDERS |

Regulatory agencies |

When necessary as required by the conduct of business |

Statutorily mandated reporting and meetings. |

International banks and investors |

Day-to-day conduct of business |

Meetings and discussions with financial institutions with which the Bank cooperates such as the World Bank, European Investment Bank, etc. |

|

Professional bodies and associations |

Day-to-day conduct of business |

Meetings, presentations, regular communications. |

|

Media |

When necessary as required by the conduct of business |

Activities (press conferences, press releases, interviews, responses to questions raised, etc.) that keep the public informed in a transparent and timely manner. |

|

General public |

In the context of social responsibility projects |

Corporate social responsibility projects and charity activities. |

Concerning stakeholder dialogue…

During 2013, the general manager and other Ziraat Bank representatives appeared on television and contributed to and/or were interviewed by publications on matters related to economic issues. They also took part in a variety of economy-, trade-, development-, and energy-related conferences held in Turkey and other countries.

During August and September 2012, bank officers and representatives met with more than 100 customers in the context of focus groups and in-depth interviews. The objective of such activities was to gain an understanding of the Ziraat Bank customer experience and to consider the degree to which customers are satisfied with the service they get from the Bank.

Through these contacts it was ascertained that Ziraat Bank is seen as:

Initiatives in which Ziraat Bank takes part or which it supports:

BANKS ASSOCIATION OF TURKEY

The Banks Association of Turkey (TBB) was set up to play a leading role in the Turkish financial services industry’s efforts to achieve international dimensions and clout through improvements in productivity and effectiveness; to protect the rights and interests of association members; to contribute to the industry’s efforts to grow, increase its competitive strength, and prevent unfair competition; and to contribute to the growth and development of banking as a profession.

Ziraat Bank’s general manager Hüseyin AYDIN is also the chairman of the association’s board of directors. In its capacity as an association member, Ziraat Bank has also been taking part in meetings of the TBB Sustainable Banking Project Best Practices Guide Working Group since 31 October 2013.

www.tbb.org.tr

FOREIGN ECONOMIC RELATIONS BOARD

The fundamental duty of the Foreign Economic Relations Board (DEİK) is to establish, through the business councils that make it up, relationships that the business world requires. By providing information that firms need for their business plans and strategies and by dealing with problems that adversely affect the emergence of new business collaborations, DEİK makes it possible for local firms to get together with their international interlocutors.

www.deik.org.tr

Ziraat Bank plays an active role in DEİK through its memberships in various southeastern European and Asian business councils.

TURKISH NATIONAL COMMITTEE OF THE INTERNATIONAL CHAMBER OF COMMERCE

Ziraat Bank is a member of a great global network formed from the national committees that make up the International Chamber of Commerce (ICC). ICC policies are shaped by its members who, through their national committees, convey the concerns of the business world to their respective governments.

icc.tobb.org.tr/index.php

CREDIT BUREAU OF TURKEY

Credit Bureau of Turkey (KKB) was set up in 1995 when eleven banks, with the support of the Banks Association of Turkey, joined forces and agreed to share information that financial institutions active in money- and capital markets and in insurance need to monitor and control retail credit accounts.

www.kkb.com.tr

TBB RISK CENTER

The Interbank Risk Center, an arm of the Banks Association of Turkey, serves as a single platform for the sharing of information about financial institutions’ exposures to customer risk as deemed appropriate by Banking Regulation and Supervision Agency (BDDK) and lenders. Under certain conditions, the center may also provide such information to individuals and organizations that are not its members.

www.riskmerkezi.org

ECONOMIC RESEARCH FOUNDATION

The Economic Research Foundation was chartered in 1962 for the purpose of conducting research into issues touching upon Turkey’s economic, social, and fiscal problems as well as more general matters and to recommend solutions for dealing with them.

www.iav.org.tr

INTERNET FRAUD ALARM SYSTEM

The Internet Fraud Alarm System (IFAS) is a KKB-hosted service through which members communicate and share information about fraudulent acts performed online. IFAS also encourages and helps banks to develop new methods to counter efforts to circumvent their own security systems.

http://rapor2012.kkb.com.tr/tr/guvenlik-sistemleri.asp

ASSOCIATION OF NATIONAL DEVELOPMENT FINANCE INSTITUTIONS IN MEMBER COUNTRIES OF THE ISLAMIC DEVELOPMENT BANK

The Association of National Development Finance Institutions in Member Countries of the Islamic Development Bank (ADFIMI) is an association of state-owned banks in countries that are members of the Islamic Development Bank. Ziraat Bank is one of the founding members of ADFIMI and its general manager is therefore entitled to take part in the association’s general meetings by virtue of his office.

www.adfimi.org

INSTITUTE OF INTERNATIONAL FINANCE

The Institute of International Finance (IIF) is one of the biggest global associations of finance-industry concerns. With 500 members from 70 countries, IFF serves as an important education and information-sharing platform.

www.iif.com

Stakeholders priorities are great importance in line with the Ziraat Bank’s strategies and objectives.

For the preparation of this sustainability report, in 2013 Ziraat Bank reviewed stakeholder requests and feedback received through different platforms in order to determine what its priorities should be.

Ziraat Bank’s sustainability priorities

For the preparation of this sustainability report, in 2013 Ziraat Bank reviewed stakeholder requests and feedback received through different platforms in order to determine what its priorities should be.

When making this determination, Ziraat Bank considered a host of issues to which the Bank gave close attention and which might have a direct or indirect impact on its own activities. Based in this assessment, Ziraat Bank decided to give priority to issues which:

the Bank itself was capable of influencing.

General priorities:

a) Economic:

b) Social:

c) Environmental:

Ziraat Bank’s Change & Transformation Project priorities

Ziraat Bank also addresses the following issues as high-priority agenda items in the context of its ongoing Change & Transformation Project:

Ziraat Bank’s sustainability strengths

Market influence and guidance:

Owing to its scale, Ziraat Bank can have a beneficial impact on the Turkish banking market.

Powerful and extensive reach:

With 1,636 service points, Ziraat Bank is the only local provider of financial products and services in four hundred small towns located all over Turkey. Such a huge service network is evidence of the economies of scale that Ziraat Bank enjoys. By processing tens of millions of payments and collections in a wide range of categories every year, Ziraat Bank helps bring more and more people into the formal economy.

150 years of knowledge and experience:

In the course of a century and a half, Ziraat Bank has been witness to world wars, depressions, periods of economic growth and contraction, and environmental disasters. It has survived by properly managing change and hardships. The knowledge and experience that have accumulated through this process constitute an intangible corporate asset that is unique among all of Ziraat Bank’s competitors.

National and international subsidiaries:

Ziraat Bank’s extensive portfolio of national and international subsidiaries underlies its ability to transform the potential inherent in existing and prospective customers into business performance.

Natural customer base in the retail, enterprise, commercial, and corporate banking business lines:

Ziraat Bank has convenient access to a customer base numbering in the tens of millions. The Ziraat brand moreover is nationally recognized as a symbol of trust and this both nourishes a natural customer base and supports its succession from generation after generation.