The Value Created and Shared

Customers

Customers are the essential justification for Ziraat Bank’s existence.

Ziraat Bank’s fundamental goal is to perpetuate and augment customer satisfaction and loyalty by supplying high-value products and services under globally competitive conditions through all of its delivery channels.

Formulated to ensure that customers’ financial needs are satisfied by providing the right solutions through the right channel at the right times and comprehensively carried out over the last two years, the Change & Transformation Project has made it possible to rapidly increase the effectiveness and productivity of its operations, customer relations, and lending policies and processes.

Through its 1,636 branches and its alternative delivery channels, Ziraat Bank has a geographical reach more extensive than that of any other bank in Turkey. Indeed in four hundred small towns, Ziraat Bank is the only local provider of financial products and services. Such economies of scale together with a century and a half of banking knowledge and experience, and an extensive portfolio of national and international subsidiaries will make it possible for Ziraat Bank to further strengthen its presence in the enterprise, commercial, corporate, and retail banking segments and to provide even more value to its customers.

ZIRAAT BANK’S SUPPORT FOR THE ECONOMY IS INCREASING STRONGLY.

Ziraat Bank’s loans, through which it supports its customers directly, increased by 55% in 2013.

Ziraat Bank’s activities are informed by its strategy of achieving balance-sheet dimensions compatible with its equity. The Bank continued to support the national economy through its lending activities without any loss of momentum in 2013. In the twelve months to end-2013, Ziraat Bank’s total lendings increased by 55% from TRY 71 billion to TRY 111 billion.

A rich lineup of products, services, and solutions is evidence of the value which Ziraat Bank is capable of offering its customers.

Ranging from deposits to loans and from foreign trade finance to cash management, all of these products, services, and solutions are focused on satisfying the financial needs of Ziraat Bank customers in the best possible way no matter what segment they may be in.

To see Ziraat Bank’s current product line categorized by segment please visit: http://www.ziraatbank.com.tr/en/index.html

Owing to their vital importance to the national economy, small- and medium-sized enterprises (SME) enjoy a high-priority position in Ziraat Bank’s customer base.

Ziraat Bank supports the real sector by focusing predominantly on the entrepreneur customer segment and strategically on the corporate customer segment.

Because they account for such a big part of the country’s commercial and industrial activity, Ziraat Bank supports SME by providing them with suitably-priced and structured operating capital and investment credit. The total volume of all cash and non-cash credit that Ziraat Bank supplied to such firms increased by 102% in 2013.

The deep-rooted and multidimensional cooperation with international financial institutions and Ziraat Bank, gives an important opportunity to support SME’s sustainable development.

In order to provide SME with financing, Ziraat Bank collaborates with many different international financial institutions such as the World Bank, European Investment Bank (EIB), the European Investment Fund (EIF), the French Development Agency (AFD), the Council of Europe Development Bank (CEB), and the German Development Bank (KfW). Two principles are common to all of these collaborations. One is ensuring that the environmental and social sustainability of projects is as intrinsic as their economic viability. The other is to concentrate on projects that will boost SME’s competitive strength by ensuring that their business practices and investments conform to international standards.

Ziraat Bank regards its collaboration with international lenders as important not just for its economic benefits but also as a means of fostering an appreciation for environmental and social sustainability among entrepreneurs and SME.

Developments in SME financing provided through Ziraat Bank’s working with international financial institutions in 2013 are summarized in the following pages.

In its collaboration with international credit agencies, Ziraat Bank supports sustainable development by lending to real-sector borrowers on terms with average maturities of 15 years.

The WB SME III credit agreement signed in 2013 calls for Ziraat Bank supplying SME with USD 300 million in funding in its capacity as an apex bank.

Under EIB I, a EUR 100 million credit facility secured from EIB to finance SME’s projects, an important point to which attention must be given is the projects’ compliance with EU environmental regulations and thus with those in effect in our own country.

Disbursement status of lines of credit provided by international financial agencies4

(As of 31 December 2013)

AGENCY |

TOTAL DISBURSED |

# SME |

|---|---|---|

World Bank |

USD 567 million |

157 |

European Investment Bank |

EUR 200 million |

199 |

European Investment Fund |

TRY 1.3 billion |

28,651 |

4) Disbursements of credit drawdowns under these programs will continue in 2014 as well.

Ziraat Bank closely monitors the performance of its SME customers to be sure that they are fully satisfying the environmental- and social-compliance terms of the World Bank SME II credit agreement (WB SME II).

As per that agreement, lending under which will cease in September 2014, projects must fully comply with World Bank environmental and social procedures as well as with currently applicable environmental laws and regulations in Turkey in order to qualify for financing.

World Bank environmental procedures are included as an annex to the WB SME II agreement and have been published on Ziraat Bank’s website. Ziraat Bank has issued directives that identify “prohibited sectors” (i.e. projects that do not qualify for financing) and also spell out in detail World Bank environmental and social compliance monitoring procedures.

Under the WB SME II agreement, environmental compliance is determined essentially on the basis of the “Environmental Due Diligence Form”. This document contains a checklist of issues such as the borrower’s line of business, the purposes for which the loan is to be used, and so on. This checklist is completed and on the basis of the results, an “Environmental Management Plan” is drawn up for the project that is to be financed. In the case of a project whose environmental risks appear to demand special attention and are therefore subject to preliminary approval as per World Bank Group environmental criteria, the project is submitted to World Bank Group environmental authorities for their consideration. Changes in borrowing firms’ employment, turnover, and export performance are monitored and sent to the World Bank in the form of regular progress reports.

Since the WB SME II agreement is due to expire on 30 September 2014, Ziraat Bank has sent a request to the Treasury to have it extended until 30 June 2015.

Ziraat Bank support for energy efficiency projects: WB Energy Efficiency Loan Program

“Energy efficiency” means minimizing the amount of energy consumed in production activities without impairing output volumes or quality and without hampering economic development and/or social wellbeing. This may be accomplished by preventing losses that occur when energy is being used, by making waste reusable through recycling, and by increasing efficiency through technological innovation.

Under a credit agreement signed with the World Bank in 2013, Ziraat Bank has begun financing SME’s energy efficiency projects. In order for such projects to qualify for financing under the WB SME II program, they must satisfy at least one of the following energy-efficiency prerequisites:

Lending decisions are informed by reports, issued before project implementation gets under way, assessing whether or not either or both of these energy-efficiency prerequisites are satisfied. The World Bank has prepared an “Energy Screening Tool” that is to be used in the assessment phase.

Loans extended under this program are also subject to the same environmental- and social-compliance requirements applicable in other World Bank loans.

In a related vein, Ziraat Bank is about to sign an agreement with a consultancy that will be responsible for increasing energy-efficiency awareness among the Bank’s employees, for providing them with training on the energy-efficiency aspects of projects whose financing is being considered, and on carrying out such projects’ energy-efficiency pre-assessments. These activities are being financed by means of an energy-efficiency grant provided by the Global Environment Facility (GEF).

Supporting SME through apex banking as well

The WB SME III credit agreement signed in 2013 calls for Ziraat Bank supplying SME with USD 300 million in funding in its capacity as an apex bank. These resources will be made available to borrowers through financial intermediaries (leasing firms and banks authorized to engage in leasing). Loans extended under this program are also subject to the same environmental- and social-compliance requirements applicable in other World Bank loans. Ziraat Bank will be responsible for overseeing such financial intermediaries’ compliance with program specifications.

Credit program requiring compliance with EU environment norms

In the financing of SME’s investments, Ziraat Bank works closely with the European Investment Bank (EIB).

Under EIB I, a EUR 100 million credit facility secured from EIB to finance SME’s projects, an important point to which attention must be given is the projects’ compliance with EU environmental regulations and thus with those in effect in our own country as well. When approving loan applications under this program, reference is made to a sectoral eligibility list prepared on the basis of EIB NACE codes, a European industry standard classification system.

Under EIB I, loans to projects for which an environmental impact assessment (EIA) report is required, to projects fraught with severe environmental risks (such as iron & steel industry projects, renewable energy projects, etc.), and to firms operating in designated conservation areas are subject to the prior approval of EIB.

In 2013 Ziraat Bank signed an agreement (EIB II) for the first EUR 100 million tranche of credit to be used to finance investments with similar environmental risks that are being undertaken by small and larger-sized firms. The Bank plans to sign an agreement covering a second EUR 100 million tranche in 2014.

Nearly 30 thousand customers were provided priority support for women entrepreneurs “My First Bank / My First Business” SME loans.

Priority support for women entrepreneurs: “My First Bank / My First Business” SME loans

In November 2012 Ziraat Bank introduced its “My First Bank / My First Business” SME credit product consisting of EIB-guaranteed loans. Launched under the “Siftah Ziraatten” slogan, the “My First Bank / My First Business” campaign targeted customers wishing to start a new business or to expand an existing one while the EIB guarantee was especially helpful to those who might otherwise have had trouble putting up collateral.

Loans supplied under this program automatically benefited from a 20% reduction below currently applicable rates; however in order to give additional support to women entrepreneurs, loans to their businesses also qualified for an additional ten percentage-point reduction. Nearly 30 thousand customers took advantage of “My First Bank / My First Business” loans. Of the total amount, more than TRY 100 million was lent to 2,578 female entrepreneurs in support of their efforts to set up their first business.

Supporting KOSGEB members in difficult times

In the wake of a terrorist bomb attack in Hatay’s Reyhanlı township in May 2013, Ziraat Bank stepped in to support customers in the area. Supplementary support loans were extended in which the Bank assumed responsibility for the interest normally guaranteed by the Small and Medium Enterprises Development Organization (KOSGEB) as well as its own principal risk. In this way, 64 local customers were provided with nearly TRY 5 million in credit support.

Similarly Ziraat Bank also continued to support those in Van who had suffered from the disastrous earthquake that recently struck the area. In 2013 the Bank supplied TRY 47 million as support credit to nearly a thousand customers in Van.

Ziraat Bank is committed to continuing to support SME and entrepreneurs active not just in agriculture but also in other business lines as well.

To fulfill this commitment, Ziraat Bank is exploring new international loan package opportunities to be offered in addition to the loans and banking products already being financed out of its own resources.

These programs, whose negotiations are still in progress and are expected to be finalized by the end of 2014, are briefly summarized below.

French Development Agency Agricultural Sector Modernization Project

Negotiations between Ziraat Bank and the French Development Agency (AFD) have been completed to provide financing for a project which that agency is conducting jointly with the Food, Agriculture and Livestock Ministry to modernize small- and medium-sized businesses active in agroindustry and food-processing.

Lending under this program is expected to begin in 2014 immediately after the signing of an agreement covering the project, which takes a very careful approach when addressing environmental- and social-responsibility issues, for which a complete battery of action plans have been formulated, and which stipulates compliance with applicable environmental laws and regulations and with corporate social responsibility principles in all aspects of lending.

German Development Bank Micro- & Agricultural SME Loan Program

Discussions with the German Development Bank (KfW) concerning a 10-year, EUR 150 million line of credit are expected to be finalized in 2014. This credit is to be used especially in rural areas to finance microloans to those involved in the agricultural value-creation chain as well as loans to agricultural SME. In order to benefit from this program, borrowers must pledge themselves to abide by environmental laws and regulations.

Signature is pending on a 7 year credit agreement for EUR 100 million that are to be lent to SME between Ziraat Bank and the Council of Europe Development Bank (CEB).

European Investment Bank / IPARD

Ziraat Bank and the European Investment Bank (EIB) are currently engaged in discussions concerning the financing of agricultural projects using grants-in-aid provided by the EU under the Rural Development component of the Instrument for Pre-accession Assistance (IPARD). To qualify for financing under this program, projects must satisfy certain prerequisites (having mainly to do with human and animal health and welfare issues) set by the Agriculture and Rural Development Support Agency (TKDK), which carries out IPARD projects in Turkey. Projects that meet these conditions will receive IPARD grants commensurate with their TKDK-funded investment once they have become operational.

About the IPARD program

Developed to support countries that are already or may become candidates for EU membership, IPARD helps them prepare for, implement, and manage the harmonization of their own agricultural, rural development, and other policies with those commonly in effect throughout the EU. Turkey’s IPARD program was formulated taking into account the country’s pre-accession priorities and needs with respect to rural development.

IPARD support is concerned with the following issues: investing in agricultural enterprises that produce milk, investing in agricultural enterprises that produce meat, processing and marketing milk and dairy products, processing and marketing meat and meat products, processing and marketing fruits and vegetables, processing and marketing fishery products, diversifying and developing farm activities, developing local produce and micro-businesses, and developing rural-area tourism and aquaculture.

Council of Europe Development Bank

Signature is pending on a credit agreement between Ziraat Bank and the Council of Europe Development Bank (CEB). This seven-year agreement for EUR 100 million consists of two parts, amounting to EUR 50 million each, that are to be lent to SME by Ziraat Bank and Ziraat Leasing respectively.

This loan is intended to give SME easier access to credit while also encouraging them to use leasing as an investment-finance tool. An autonomous agency of the Council of Europe, CEB adheres to EU standards with respect to environmental and social responsibility issues and therefore requires compliance with the European Charter of Human Rights and the European Social Charter as well as with currently applicable laws and regulations during the harmonization process.

During 2013, 180,000 producers used their Başakkart cards to borrow TRY 2.1 billion worth of an aggregate agricultural credit limit amounting to TRY 2.9 billion.

Ziraat Bank: Agricultural Sector Key Indicators5

(End of 31 December 2013)

Livestock-financing loan customers since 2010 |

152,100 |

Tractor-financing loan customers since 2004 |

133,937 |

Greenhouse-financing loan customers in the last 10 years |

83,559 |

Agricultural loan customers borrowing against their Başakkart cards in 2013 |

180,000 |

5) For Ziraat Bank’s 2013 Key Indicators see http://www.ziraatbank.com.tr/en/InvestorRelations/Documents/AnnualReports/ AnnualReports.pdf page 10-11.

ZİRAAT BANK’S APPROACH TO THE AGRICULTURAL SECTOR

Ziraat Bank’s priority objectives in agricultural sector financing include fostering the growth and development of Turkish agriculture and giving it the strength to compete at the global level.

Maintaining a presence in every aspect of agricultural production, agroindustry production, and industrial production financing in the conduct of its Change & Transformation Project, Ziraat Bank has made it its primary goal to work with all actors on the value-creation chain platform taking into account the added value that is generated.

At every stage of agroindustry from soil to shelves, which is to say from sowing and raising crops to the domestic and international marketing and sale of agricultural produce, Ziraat Bank engages in efforts that aim is to stand by its customers in all aspects of their economic activity.

Foreseeing that agriculture is going to be a business line every bit as important as energy in the future, Ziraat Bank will continue to be the biggest supporter of the Turkish agricultural sector as it strives to increase its efficiency and competitive strength.

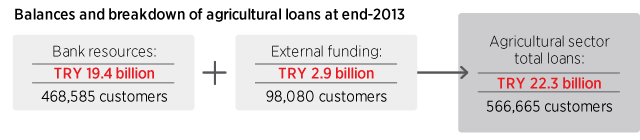

The total value of all Ziraat Bank lending to finance the agricultural sector reached TRY 22.3 billion.

Seeking to be a customer’s primary and proactive bank in all aspects of agricultural production up to and including the final consumer, Ziraat Bank continued to support the sector in many different ways last year. At end-2013, the total value of all Ziraat Bank lending to the agricultural sector amounted to TRY 22.3 billion while the number of its loan customers stood at 566,665.

In 2013 Ziraat Bank lent TRY 11.8 billion worth of its own resources to 342,978 individual and corporate customers and it also extended TRY 305.8 million worth of credit from external funding to 22,899 producers. 47% of Ziraat Bank’s agricultural loan portfolio (worth TRY 9,039 million) consisted of medium- and long-term investment-finance loans while the remaining 53% (worth TRY 10,369 million) consisted of short-term working capital loans.

Başakkart: Practical financing solutions that make producers’ lives easier.

Başakkart is a more than just a bank card that Ziraat Bank issues to its agricultural sector customers: It’s also a financing tool.

During 2013, 180,000 producers used their Başakkart cards to borrow TRY 2.1 billion worth of an aggregate agricultural credit limit amounting to TRY 2.9 billion. With Başakkart, producers significantly reduce the burden of financing their production processes by purchasing such inputs as fuel, seed, fertilizer, pesticides, feed, and veterinary services from Başakkart merchant partners on interest-free terms of up to five months.

As a requirement of its mission, Ziraat Bank continues to supply low-interest agricultural loans.

In May 2013, Ziraat Bank reduced the interest rates on its agricultural loans, in some cases to the single-digit range. The rate charged on agricultural loans with terms of one year or less was lowered to 8% while the rates charged on loans more than one year up to four and on loans more than four years’ duration were set at 10% and 11% respectively.

Under Council of Ministers decrees, the Bank’s agricultural-sector customers found it possible to borrow at rates that varied between 0% and 8.25% a year when state subsidies provided for specific production categories are taken into account. In 2013, 254,610 producers and firms operating in the agricultural sector were provided with reduced-interest loans amounting to TRY 9.2 billion.

In the conduct of its low-interest lending, Ziraat Bank also provides low-interest loans to firms engaged in organic farming and controlled under-cover cultivation and/or implementing good agricultural practices with the aims of protecting and improving natural resources and/or encouraging environmentally sustainable and high-quality food production. Low-interest loans are also extended to producers who want to use renewable sources of energy (such as solar and biomass) in the conduct of their production activities.

A financial model that promotes agroindustry-producer collaboration

In 2013 Ziraat Bank signed protocols with 18 firms active in the seed, sugar beet, trout and poultry sectors under which the firms were provided with an aggregate TRY 128 million line of credit to extend to 29,000 contractual producers as operating and investment-finance loans on favorable terms.

Continued success of the interest-free livestock financing loan program

In August 2010 Ziraat Bank began extending interest-free livestock financing loans both to meet the needs of customers wishing to modernize or increase the capacity of existing cattle, sheep, and poultry breeding and fattening businesses and to support the establishment of new livestock enterprises. Under this program last year, the Bank supplied 30,886 customers with cash loans amounting in total to TRY 579 million. This performance brings the total number of such customers to 152,100 since the beginning of the program and the total amount lent to them as interest-free livestock financing to TRY 6.9 billion.

More than 133,000 customers have benefited from fixed-interest tractor finance loans.

In 2013 Ziraat Bank extended TRY 1,052 million worth of fixed-interest tractor finance loans to 25,133 customers. Since the introduction of this program in 2004, a total of TRY 4,294 million has been lent to 133,937 of the Bank’s customers.

More than two billion worth of greenhouse cultivation financing support in a decade

Ziraat Bank lent TRY 306 million to finance the greenhouse cultivation activities of 5,327 customers in 2013. Over the last ten years, the Bank has supplied a total of TRY 2.1 billion in loans to 83,559 customers to finance greenhouse construction, modernization, production, and similar undertakings.

In 2013 Ziraat Bank also handled:

Creating more value for customers: Ziraat Bank takes part in many agriculture-oriented activities while also increasing public awareness of the industry’s development.

Total and Ziraat Bank/Ziraat Sigorta’s share of total agricultural insurance premium production in 2013

PREMIUMS / SECTORAL SHARE |

NET PREMIUMS (TRY) |

NET POLICIES ISSUED |

|||

|---|---|---|---|---|---|

SECTOR |

ZİRAAT SİGORTA |

SECTOR |

ZİRAAT SİGORTA |

||

End-2012 |

End-2013 |

Change |

Change |

Change |

Change |

41% |

45% |

6% |

17% |

20% |

31% |

Ziraat Bank also creates value through its efforts to help the agricultural sector protect itself against the risks to which it is exposed.

Ziraat Bank’s agricultural insurance activities are conducted through a sound bancassurance approach that has been developed through its subsidiary, Ziraat Sigorta.

2013 was a record-breaking year for agricultural insurance premium production in Turkey. The number of TARSİM-issued policies increased by 20% to 891,876 last year while total premium production was up by 6% to TRY 526,835,325.

In 2013 Ziraat Sigorta was once again the country’s leading supplier of agricultural insurance. The 50% rise in Ziraat Sigorta’s premium production, largely for crop coverage, was the biggest contributor to the agricultural insurance business line’s growth. Ziraat Sigorta by itself accounted for 45% of TARSİM’s premium production last year.

A significant proportion of the financing that Ziraat Bank provides to the agricultural sector consists of loans to micro-scale, family-owned businesses. When considered in the context of the social impact of product and services of Ziraat Bank’s, offerings, this is clear-cut evidence of the contributions that the Bank makes to improving welfare and increasing employment in rural areas.

Ziraat Bank will continue to provide multidimensional support to agriculture and thus contribute to its growth and development.

Ziraat Bank is committed to playing a leading and stakeholding role in order to support real-sector projects both in Turkey and abroad.

PROJECT FINANCE ACTIVITIES AND SUSTAINABILITY AT ZİRAAT BANK

The contributions that Ziraat Bank makes to economic development are also to be seen in the project finance business line.

In 2013 Ziraat Bank once again played an active role in financing projects in many different sectors so long as they effectively contribute to the national economy, create high added value, and are capable of generating their own revenue streams.

In the projects that Ziraat Bank financed in 2013, careful attention was given not just to their contributions to Turkey’s economic development but also to their environmental and social benefits as well. Examples of such undertakings include projects that call for recycling and recovering waste paper to make it economically useful, highway projects that improve transportation by shortening distances and thus conserve fuel, financing projects that enhance local producers’ ability to compete, renewable energy projects, projects to prevent illegal tapping of the electrical power grid, and projects to increase local employment through the creation of new production opportunities.

The Bank is committed to playing a leading and stakeholding role in order to support

real-sector projects both in Turkey and abroad.

The importance of environmental and social risk assessment

In the conduct of its project finance activities, Ziraat Bank draws up project-specific lending agreements and has assessments performed of the social and environmental risks that a project entails.

For every project, a preliminary study is carried out to determine if the project needs an environmental impact assessment (EIA). The lending process may not proceed unless an “EIA Favorable” or “EIA Not Required” decision is reached. In the case of projects fraught with severe environmental risks, an “environmental consultant” must be designated even if a favorable report has been issued.

During the construction and operation stages, the independent technical consultant and the environmental consultant responsible for the project may be requested to submit reports at prescribed intervals if such are deemed to be necessary. These reports make it possible for the Bank to keep track of project firms’ compliance with the environmental and social conditions set out in the lending agreement.

Depending on the nature and location of an investment as well as other considerations, investor firms may be required to obtain appropriate licenses from the Cultural Heritage Protection Authority in order to help prevent activities that may be detrimental to historical monuments etc. During the investment phase, construction firms are required to supply proof that they have obtained necessary building licenses from local municipal authorities for approved projects. This rule supports efforts to ensure that construction takes place in compliance with laws and regulations and to keep building activities from causing environmental harm.

Investment monitoring reports are issued detailing the progress of projects and investments being undertaken by firms that have borrowed from Ziraat Bank. In this process, the Bank keeps track of projects not just as a lender but rather as a partner in the investment.

In the conduct of Ziraat Bank’s project finance operations in 2013, the social/environmental risks of four of fourteen projects with a total risk exposure of USD 1.6 billion were subjected to regular auditing and reporting by an environment consultant. Based on the results of such auditing, no project was found to be in breach of its lending agreement terms.

Loans that are extended in collaboration with the World Bank are periodically subjected to environmental documentation audits as well as to financial audits. While such audits are performed by randomly sampling records, World Bank officers also have the right to visit and inspect projects. During 2013, no project being financed with World Bank credit was visited or inspected by any World Bank officer.

Similarly during the reporting period, no project financed with European Investment Bank or European Investment Fund credit was subjected to any environmental audit by any of their officers.

In 2013, the contracts governing 12 of 26 currently active projects contained clauses pertaining to the protection of human health.

In 2013 the Bank handled a 4,282,811 payments amounting to TRY 8,132 million in total.

Project finance and human health

The project finance agreements that Ziraat Bank enters into may also contain clauses pertaining to the prevention of activities that are detrimental to human health.

In 2013, the contracts governing 12 of 26 currently active projects (corresponding to 46% of the total) contained clauses pertaining to the protection of human health. In four projects, there were also clauses calling for the inclusion of a social-impact study in the environmental consultant’s report.

World Bank investment project social-impact control mechanisms

Although there are no projects specifically subject to human rights auditing that are covered by lending agreements with international thematic funds, World Bank-funded investment projects do include social-impact control mechanisms that are integrated into their environmental-impact control mechanisms.

For an investment that is to be financed by Ziraat Bank with World Bank-supplied funding, an environmental management plan must be prepared and people in the project’s locality must be informed of this by means of public meetings. In addition, care is given so that projects being financed do not lead to unnecessary displacement and projects are not financed if they make it necessary for a significant number of people to be involuntarily resettled.

Agricultural loans and manufacturing firms

When evaluating agricultural projects, points are given for the inclusion of good agricultural practices and for adherence to organic farming criteria and practices. The inclusion of such practices impacts favorably on a customer’s risk rating.

In the case of manufacturing firms and the compliance of their production facilities, the absence of apparatus such as ecological purification, flue filtration, and similar systems in sectors where such equipment is deemed necessary or whose use is legally mandated earns a facility a “Poor” or “Very Poor” score and adversely impacts a firm’s overall rating.

THE VALUE CREATED FOR PUBLIC AGENCIES AND ORGANIZATIONS

Public agencies and organizations represent an important and natural customer base for Ziraat Bank.

In 2013 Ziraat Bank’s Ankara Public Corporate Branch was put into service in order to provide a sound and effective basis for the service relationship between the Bank and public agencies and organizations. The Bank intends to increase the number of such branches and also plans to open “public enterprise branches” before the end of 2014. Another Ziraat Bank objective is to provide firms that supply the public sector with increasingly more financial services. The Bank anticipates intensifying its marketing efforts in this direction in 2014.

Ziraat Bank is the main distribution channel for state support payments in Turkey.

Every year Ziraat Bank processes tens of millions of support payments made by a host of public agencies and organizations. In that capacity, it serves as the main distribution channel in the management of state social policy.

In 2013 Ziraat Bank successfully handled the following payments on behalf of public authorities:

These activities are summarized briefly below.

Agricultural Support Payments

Last year Ziraat Bank continued to process agricultural support payments as required by laws, regulations, and administrative communiques. In 2013 the Bank handled a 4,282,811 payments amounting to TRY 8,132 million in total.

Housing Benefit Payments

Under Statute 5664 (Act concerning the payment of housing benefits to those entitled to them) dated 22 May 2007 and Regulation 26613 dated 14 August 2007, Ziraat Bank is charged with handling payments made under a protocol which the Bank has entered into with Emlak Konut Gayrimenkul Yatırım Ortaklığı A.Ş. (EGYO), a semi-privatized property & housing real estate investment trust. The Bank continues to make payments as instructed by EGYO. In 2013 Ziraat Bank made 55,993 payments amounting to TRY 16.5 million in total to such beneficiaries.-

Employee Savings Incentive Payments

Ziraat Bank processes Employee Savings Incentive Program payments and collections on behalf of the Treasury pursuant to principles and procedures set forth in applicable laws and regulations. In 2013 the Bank made payments amounting to TRY 316.5 thousand in total to 383 such beneficiaries.-

Protocol-Based Payments & Collections

Ziraat Bank provides public agencies and organizations with payment and collection processing services under protocol agreements that it enters into with them. In 2013 the Bank processed 127,030,776 such transactions amounting to TRY 167,419 million in total.

ZİRAAT BANK: TURKEY’S CUSTOMER-FOCUSED BANK

For the first time in 2013 the Banking Regulation and Supervision Agency (BDDK) included “customer focus” along with “retail customer service: and “financial consumer protection” among the categories of criteria according to which it audits the Turkish banking industry.

Under the Customer-Focused Audit model (MOD) that BDDK has developed for this purpose, retail banking products and services are examined and rated on the basis of:

When introduced as a pilot project, BDDK checked the performance of banks supplying 95% of the sector’s retail banking services against these criteria and assigned them “MOD points”. Ziraat Bank ranked first among all the Banks so audited by earning the greatest number of points.

Enhancing value to customers: Ziraat Bank’s New Generation Online Branch opened for service in 2013.

Ziraat Bank’s online branch has been redesigned to give its customers a faster, more convenient, and more functional internet banking experience. With its information architecture, infrastructure, design and new-generation information technology, the Ziraat Bank Online Branch’s new features and its simplified, practical layout make it as enjoyable to use as it is easy.

The goal of the Ziraat Bank New Generation Online Branch is to allow customers to take care of their banking business more effectively: newly-added screens give customers convenient access to the information and transactions they want while a “smart calendar” module lets them set reminders for themselves on dates in the future.

With its easily-accessible menu of actions categorized according to needs and with its user-friendly look, the Ziraat Bank New Generation Online Branch seeks to exceed customers’ expectations. Owing to its streamlined design, the branch is just as functional on mobile devices as it is on computers, making it usable wherever and whenever a customer needs to.

Thanks in part to the launch of the New Generation Online Branch, the number of Ziraat Bank online banking customers increased by 50% in 2013.

In the twelve months to end-2013, the number of customers registered to enter the Ziraat Bank online branch grew by 50% and reached 2.7 million. Paralleling this growth, the number of financial transactions performed increased by 12.9% from 31 million to 35 million over the same period while the total value of such transactions grew by 51.5% to TRY 90.9 billion.

Enhancing value to customers: Delivering even better service to customers with disabilities

In keeping with its customer-focused service approach, offering banking products and services in formats that are convenient for customers with disabilities to use is an important priority for Ziraat Bank.

The entrances to the great majority of Ziraat Bank branches are designed to make them usable by customers with orthopedic disabilities. Work is currently in progress to give such customers more convenient access to the Bank’s branch, ATM, and online banking services. Under a pilot project that is currently under way, a number of branches and ATM units are being redesigned so as to make them even more usable. The Bank plans to extend these changes to other locations based on the results of this project. Under another project, revisions are to be made that will allow visually-impaired customers to benefit from Ziraat Bank’s services too.

The Ziraat Bank online branch was designed to be usable by those who are visually-impaired. Work is currently in progress to make changes in the Bank’s mobile banking applications so that they too may better serve the needs of such users.

Enhancing value to customers: 150 new branches in 150th year

Ziraat Bank opened more new branches–150 in all–than any other bank in Turkey last year.

In 2013 all processes related to branch openings, closures, and relocations were integrated into Ziraat Bank’s electronic task flows. This not only reduced the operational workloads involved but also further improved objective decision-making through integration with Geographical Information Systems.

In 2011 Ziraat Bank’s network consisted of 1,434 branches; as of end-2013 there were 1,636. During the same, Ziraat Bank’s share of the total number of branches in the Turkish banking system increased to 15.0%.

This growth in branch numbers not only brings the Bank closer to customers but also helps reduce the environmental pollution that would result in customers having to use transportation to come to a branch.

The wide coverage of the Bank’s extensive ATM network also brings it closer to customers. At end-2013, 12.7% of the ATM units operating in Turkey belonged to Ziraat Bank.

FINANCIAL LITERACY

In today’s world, well-educated people are what enable their societies to stand out and compete. As part of the process of increasing financial affluence, financial literacy is of great importance to Turkey’s development and progress vision because it helps make consumers of financial products and services better aware of their nature and underlying concepts and thus able to make informed choices about risks and alternatives.

The proper management of material resources is as crucial to societies’ future as it is to individuals’.

Knowledge not only underlies economic empowerment but also brings with it economic strength and self-confidence. Financial literacy is valuable because it nourishes the propensity for long-term saving and generates the essential national resources needed to finance investments.

Ziraat Bank believes in the need for financial literacy, which is to say in the need to improve people’s ability to make informed decisions, and it therefore engages in systematic efforts in that direction. Beginning with making certain that a customer has proper access to correct information about the Bank’s products and services through every channel, such efforts embrace a wide range of activities that include financial-themed meetings and information workshops with focus groups. Members of Ziraat Bank’s senior management also appear as speakers at many events while interviews given to newspapers and magazines provide opportunities to communicate messages that will contribute to financial literacy among a wider audience.

The Bank’s products and services were promoted through a diversified lineup of communication channels such as TV, radio, cinema, newspapers, magazines, and the internet on the occasion of the Bank’s 150th year in business.

ZİRAAT BANK CONSTANTLY ENGAGES IN COMPETITION-MINDFUL MARKET COMMUNICATION ACTIVITIES.

Advertising, promotion and other marketing communication tools are foremost among the most important elements enabling advertisers to communicate with consumers. Marketing communication helps improve an advertiser’s effectiveness both nationally and internationally while also providing tangible benefits to consumers, firms, and the public at large.

Taking this awareness as its point of departure, Ziraat Bank seeks first of all to ensure that all of its marketing communication and promotional activities inform customers correctly.

Ziraat Bank’s marketing communication policy is based on the following principles:

Ziraat Bank regards sponsorships as a means of communicating with the public and therefore engages in such projects systematically.

Celebrating Ziraat Bank’s 150th anniversary, 2013 was a busy year for the Bank from the standpoint of marketing communication.

The Bank’s products and services were promoted through a diversified lineup of communication channels such as TV, radio, cinema, newspapers, magazines, and the internet. A wide variety of activities were also conducted on the occasion of the Bank’s 150th year in business. For further details please see page 52 of this report.

While restructuring itself in line with its new customer-focused business model, Ziraat Bank continues to meet the banking product and service needs of its corporate and retail customers by providing them through the right delivery channels, on time, and on favorable terms.

RESTRUCTURING EFFORTS CONTRIBUTE TO RISK MANAGEMENT AND ENHANCING SUSTAINABILITY PERFORMANCE.

While restructuring itself in line with its new customer-focused business model, Ziraat Bank continues to meet the banking product and service needs of its corporate and retail customers by providing them through the right delivery channels, on time, and on favorable terms. The Bank has redefined its business practices, its customer segmentation, and its domestic and international subsidiary organizational structure in order to incorporate all of the following elements:

For further details about these projects please see page 35 of Ziraat Bank 2013 Annual Report. http://www.ziraatbank.com.tr/en/InvestorRelations/Documents/AnnualReports/AnnualReports.pdf

Goals for the future: