2012 Annual Report

Home Page

Introduction

Management and Corporate Governance Practices

Financial Information and Risk Management

Türkçe

Financial Indicators

Ziraat Bank set its financial management

strategy as:

• possessing a shareholders' equity that is aligned with the size of the balance sheet,

• increasing the relative share of loans,

• attaining an effective and diversified funding resource.

(TL Million) |

2012 |

2011 |

Change (%) |

|---|---|---|---|

|

|

|

|

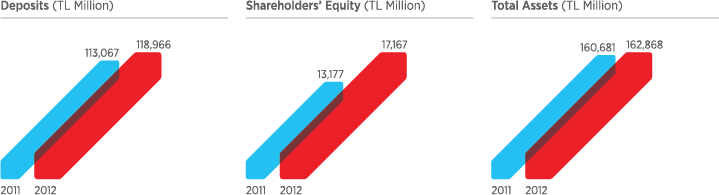

Total Assets |

162,868 |

160,681 |

1 |

Liquid Assets and Banks |

22,647 |

15,593 |

45 |

Securities Portfolio |

65,469 |

70,766 |

-7 |

Loans |

71,426 |

71,430 |

0 |

Deposits |

118,966 |

113,067 |

5 |

Shareholders’ Equity |

17,167 |

13,177 |

30 |

Interest Income |

14,811 |

13,706 |

8 |

Interest Expense |

7,910 |

8,465 |

-7 |

Pretax Profit |

3,505 |

2,780 |

26 |

Net Profit/Loss |

2,650 |

2,101 |

26 |