2012 Annual Report

Home Page

Introduction

Management and Corporate Governance Practices

Financial Information and Risk Management

Türkçe

Ziraat Bank's Financial Standing, Profitability and Solvency

Having defined its goals as stable growth, sustainable profitability and productivity within the frame of strengthening financial structure, Ziraat Bank brought its balance sheet structure in alignment with its shareholders’ equity on the back of the assets and liabilities management strategies pursued during 2012, and the positive progress continued with respect to capital adequacy, profitability and productivity.

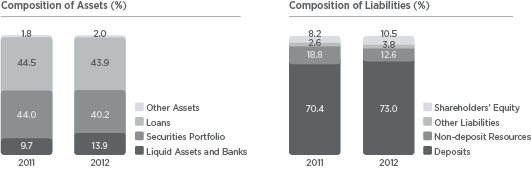

The Bank’s total assets rose to TL 163 billion and its shareholders’ equity to TL 17 billion at the end of 2012. As a result of the retention of the prior year profit, the percentage of shareholders’ equity went up from 8.2% to 10.5% in the twelve months to end-2012. The Bank set it as its primary strategy to retain earnings until a shareholders’ equity structure that is aligned with the targeted balance sheet size is attained. Until then, the Bank will move ahead with a balance sheet structure in a size that is compatible with its shareholders’ equity.

Aiming to render profitability sustainable, which is an important element with respect to shareholders’ equity management, the Bank increased its net profit by 26% to TL 2.7 billion in 2012. There was a marked rise in profitability ratios, as well, and RoE and RoA, which were 16.1% and 1.3% respectively at year-end 2011, rose to 17.6% and 1.7%. At 18.96, the Bank’s capital adequacy ratio exceeded the sector’s average.

Within the frame of the strategy to switch from marketable securities to loans in its balance sheet, the Bank focused on lending activities. As a result of its activities, total lending amounted to TL 71.4 billion at the end of 2012, and accounted for 44% of assets. The share of marketable securities portfolio to assets declined from 44% in 2011 to 40%. Efforts will be ongoing also in the years coming to match the sector’s norms in terms of the share of marketable securities within the balance sheet. In 2012, the Bank’s NPL ratio rose to 2.8%. The NPL ratio that the Bank keeps equal to the sector’s average without disposing of any assets for its non-performing loans indicates that it has good assets quality.

In line with our management concept focused on ensuring diversity and depth in funding, and our goal to secure broad-based and low-cost funds, total deposits were worth TL 119 billion. Ziraat Bank remained the sector’s leader in total deposits in 2012. While the share of deposits to liabilities was 73%, that of non-deposit resources including funds was 12.6%. To support funding diversity and quality and to extend average maturity on funds, TL-denominated Bank bonds/bills issues were initiated in February 2012, under which five public offerings were carried out for a total amount of TL 4 billion. BRSA’s permission was obtained for issues with a total worth of TL 7 billion as of December 2012. The funding structure will be diversified through non-deposit financing resources including eurobond issues and syndication loans in 2013 and thereafter.

At TL 14.8 billion, interest income continued to represent the Bank’s most important income item in 2012. As a result of the lending activities during the reporting period, the share of interests charged on loans within total interest income rose from 54% to 59%. Our efforts to improve net interest margin continued, and resulted in 32% rise in net interest income during 2012. The Bank’s activities aimed at growing non-interest income brought about 20% hike in net fee and commission income in 2012.