2012 Annual Report

Home Page

Introduction

Management and Corporate Governance Practices

Financial Information and Risk Management

Türkçe

Macroeconomic and Sectoral Outlook

For Turkey, 2012 was a year of preparing the suitable ground for a soft landing process with the target of healthy and sustainable growth.

Outlook of the Global Economy

In 2012, the risks against the global economic recovery gradually lessened, but the issues were yet to achieve a sustainable solution trend.

While the developments relating to the Eurozone have been telling on the global economy, rates of growth generally declined in developed and emerging countries, and high volatilities were observed in the global risk appetite.

The highlights of 2012 included the unemployment and the fiscal cliff in the USA, the banking sector, growth, employment and trust issues in the Eurozone, the new government that took to the power in Japan which gives the foreground to growth and to monetary expansion in the same direction, and the monetary expansion policies maintained by other developed countries.

Despite the relatively positive growth rates attained in the US economy, the US Fed was forced to launch a third round of quantitative easing in 2012 due to the housing and especially employment markets that failed to capture the desired levels. While the US Fed expressed a deadline for this decision at the start, it pegged the easing policy to unemployment and inflation levels by a subsequent decision. The so-called “fiscal cliff” issue, which stipulates the elimination of tax advantages provided in previous periods and reduction of public spending, caused the risks to come to the forefront in the last quarter of the year on the part of USA, and bore a relatively negative impact upon global markets. With the solution of the fiscal cliff by postponing it at the onset of 2013, the concerns about this issue have been put off at least until mid-2013.

Apparently, central banks of developed countries continued to loosen their monetary policies in 2012 in conjunction with the outlook of global growth. The European Central Bank (ECB) announced a short-term bonds buying program for countries suffering from debt issues, in addition to monetary expansion programs, and strove to prevent the high levels of borrowing interests in Spanish and Italian economies. The ECB’s efforts to protect the euro and to keep the banking industry on its feet have been influential in alleviated concerns regarding the region. Hence, in parallel with the concrete steps taken towards resolving the issues in the Eurozone, the concerns hovering over this geography relatively lessened at the end of the year. However, it is still early to suggest that things are moving along a definitive solution path. It is another determination that the debt and growth issues are changing the political visage of Europe.

One of the countries that turned to monetary expansion in the last quarter of 2012, Japan upped its inflation target to 2% and announced that it will purchase certain amounts of assets every month starting from 2014 without quoting a deadline. The loose monetary and exchange rate policy that the new government will pursue led to rearticulation of the currency wars. As such, the Bank of Japan, Japan’s central bank, has been the first central bank to target a higher inflation level than the most recent one.

The downward trend in the growth rate of China, the greatest contributor to the growth of emerging economies, persisted throughout 2012. Having completed 2012 with a growth rate of 7.8%, China entered into a recovery trend toward the end of the year, which brings about an anticipated high rate of growth, although below the average trend, in the year ahead. Based on the most recent data, China seems to have qualified as the world’s biggest economy. Characterized as the country whose economic and financial activities are most closely monitored among the BRICS countries and one who significantly affects the global financial architecture, China is named among the most important countries.

While the short-term capital flows to emerging economies gained speed in parallel with the risk appetite that increased in conjunction with the continued global monetary expansion in 2012, it has followed a fluctuating course. Emerging economies were also confronted with declining growth, and risks over inflation and exchange rates gained the foreground.

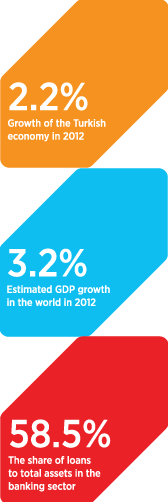

According to IMF predictions, the GDP growth in the world that was estimated to be 3.2% in 2012 is anticipated to increase moderately to 3.5% in 2013. However, it is believed that the emerging economies will grow faster as they did during the crisis period, attaining 5.5% growth in 2013, and thus steer the worldwide growth.

The IMF forecasts 1.4% GDP growth in developed economies in 2013. This anticipation hints at some improvement in economic activities this year, and the start of positive progress towards solution of issues, even if they will remain to be solved. However, in 2013, all countries will be looking at a year when the issues related to the real economy will continue in many countries, the element of trust in the markets is yet to be rebuilt, and problems in relation to employment and investments will sustain. It is a wish shared by all that the rebalancing, the indications of which were started to be observed in 2012, will continue and further increase during 2013.

2013 is expected to see some improvement in the economic activities of developed countries and the start of positive progress even if solution of issues will remain elusive.

Outlook for the Turkish Economy

For Turkey who exhibited a relatively higher performance amid the global crisis, 2012 was a year of preparing the suitable ground for a soft landing process with the target of healthy and sustainable growth.

The economic rebalancing process became more pronounced, the inflation adopted a downturn, the current account balance showed improvement that went on throughout the year, and its ratio to GDP declined to nearly 6.5%. The rapid growth momentum of 8.5% captured in 2011 lost pace as a result of the measures adopted and 2.2% growth was attained in 2012. Economic activity continued to decelerate throughout 2012 and while the contribution of the domestic demand to growth diminished, the contribution of net foreign demand turned to positive, and the growth composition acquired a healthier outlook. The foreign demand was restrained by the weak growth in conjunction with the sustained issues in the Eurozone, and the share of export to European countries decreased. However, African and Middle Eastern countries secured constantly rising shares in Turkey’s exports as a result of our increased share in alternative markets in the past period, and exports to these countries performed positively, as a result of which net exports proved to be a major contributor to annual growth.

The inflation adopted a downturn, the current account balance showed improvement that went on throughout the year.

The loss of pace in the rate of increase in tax revenues in connection with the decelerated economic activity and the accelerated non-interest expenses have led to a relative weakening in the budget performance, and the ratio of budget deficit to the GDP was near 2.3%, which is the Medium Term Program target.

After registering 10.45% in the previous year due to the depreciated Turkish lira, tax adjustments, and the rising food prices, the inflation declined to its lowest year-end value since 2005 at 6.16%, as a result of the positive course of unprocessed food prices, the policies implemented, and the elimination of the base effect of the previous year in 2012.

While there was an increase in the overall risk appetite as a result of the monetary expansion policy implementations by the central banks of developed countries particularly from the third quarter of 2012, the short-term capital flows to emerging countries showed a reviving trend and the risk premiums of emerging economies declined in parallel with the rising global risk appetite. Turkey also got her share of short-term capital flows as a result of the macroeconomic indicators data and particularly current deficit data that turned out to be more positive than what was anticipated and the upgrade of Turkey’s long-term credit rating to investment grade by Fitch Ratings in November.

As growing capital flows increased the tendency of emerging countries to turn to alternative measures apart from customary policies, they have reestablished the importance of possessing a loose policy framework. In this frame, the Central Bank of the Republic of Turkey (CBRT) developed additional tools that support financial stability with the policy mix it has been implementing since end-2010. In the timeframe from the last quarter of 2011 until the middle of 2012, monetary tightening was implemented at certain intervals due to the fluctuating risk appetite and the risks over the outlook of inflation. From June 2012, the liquidity supplied to the market was increased to gradually decrease funding costs because of the improved global risk appetite, the strengthened economic rebalancing, and the downward trend of inflation, and a more supportive stance was adopted progressively starting from the middle of 2012. In a period when inflation also took a downturn owing to its multi-purpose and multi-tool policies, the CBRT played an active part in the markets proactively using tools such as the interest rate corridor, required reserves, and reserve option mechanism, while observing the financial stability along with the price stability.

For our country, 2013 is expected to be a more positive year than 2012 with respect to growth, inflation and current deficit trends. In this framework, it is expected that 2013 will be a year when all economy authorities will be striving to move to a stable and sustainable growth that is backed by the monetary policy, focused on domestic demand provided that it is moderate and keeps an eye on the inflation trend, as well as on exports. In the year ahead, global developments, commodity prices and geopolitical risks will continue to affect the macro framework and policies.

Based on the prediction that the overall levels of interest rates will remain low, low-cost financing facilities secured from abroad are expected to continue. Most certainly, the multi-tool and multi-purpose monetary policy that sticks to a cautious stance and the relentless adherence to budget performance will also be persisted. Along these lines, it is wished that 2013 will be a year of continued positive decoupling recently captured among world economies, and of economic transformation where the wins are protected in the medium term and stability is captured.

Developments in the Banking Sector

Despite the ongoing uncertainties inflicting the global economy that is in the process of seeking stability, increased regulatory requirements and intensive competitive environment, the Turkish banking sector recorded a stable growth.

Against the backdrop of a global economy that is undergoing a rough time since 2008 that marked the onset of the global economic crisis, the Turkish banking industry played a key role in the preserved solid structure of the Turkish economy with its robust capital structure, asset quality and profitability. By transferring funds to the economy, the Turkish banking sector was highly influential in the acceleration of economic activities and our country’s rapid growth in the aftermath of the global economic crisis.

2012 has been a year of controlled expansion for the credit volume of the national banking sector in parallel with the overall economy so as to ensure sustainable growth.

The increased funding costs within the frame of measures adopted to achieve financial stability in the first half of 2012 put the brakes on the growth of the banking industry. From the second half of 2012, however, the growth regained speed owing to the CBRT’s approach aimed at increasing the liquidity in the markets and reducing funding costs, in line with the positive developments in the current deficit and economy.

The rising profit of the industry in 2012 was driven by the non-interest income that increased as a result of higher gains on exchange differences, fees, commissions and banking service revenues, and the growing net interest margin. On the other hand, there was some rise in the ratio of non-performing loans to total lending.

The asset structure of the banking sector represents a striking change. According to the data released by the Banking Regulation and Supervision Agency (BRSA), the share of loans to total assets went up from 44.9% in 2006 to 58.5% at the end of 2012.

In 2013...

In the year ahead, the Turkish banking sector is anticipated to display a growth that is parallel to the economic growth on the back of its robust capital structure and asset quality, whereas banks that also keep an eye on profitability and productivity will increase their focus on non-interest revenue items due to the changing interest margins.

The expansion in lending is expected to continue in a balanced manner during 2013, owing mostly to the effect of the SME and consumer loans. The rate of growth is anticipated to be 14-16% for lending and 12-14% for deposits in the coming year.