Value for Our Country

I

International Banking

Correspondent Banking Network

140+ Countries

Number of Correspondent Banks

1,700+

Ziraat Bank, which is the most widespread Turkish bank worldwide, has a strong and respected position in international banking with its strong correspondent relationships and solid funding base.

Steadily growing foreign trade volume

Ziraat Bank’s correspondent banking network, which has been expanded for many years in order to fulfill the requirements of its customers for foreign trade transactions and international payments, covers more than 1,700 correspondent banks in more than 140 countries. As a result of the endeavors carried out for the products and services offered to customers in the field of foreign trade, Ziraat Bank has quadrupled its foreign trade volume over the last 10 years and reached a foreign trade volume of USD 117 billion as of year-end 2024. The Bank is able to offer its customers fast and more economical alternative solutions by drawing on the benefit of its extensive correspondent network in domestic and international foreign currency (FX) transfers, increasing the number and volume of FX transfers it mediates in every year.

Ziraat Bank is endeavoring on the basis of ensuring sustainable customer satisfaction in the field of foreign trade with its specialized staff and facilitates customer access to the wide range of financial products they need, such as foreign financing, letter of credit discount, avalised promissory note, bill of exchange and promissory note discounts. Ziraat Bank works in close cooperation with correspondent banks and export credit institutions such as Hermes, SERV and SACE to fulfill the financing requirements of its customers in their foreign trade transactions and provides sustainable medium and long-term country loans to its customers.

In order to meet the funding requirements of customers importing certain goods from Saudi Arabia, an agreement was signed with Saudi Exim Bank under the guarantee of Ziraat Bank. Within the scope of the agreement, USD 100 million worth of funds have been provided to companies importing non-oil products from Saudi Arabia under the guarantee of Ziraat Bank.

Ziraat Bank, one of the leading banks in the field of foreign trade, was also among the banks primarily preferred by customers in foreign trade and foreign currency transfer transactions in 2024.

Customer-oriented foreign trade operations

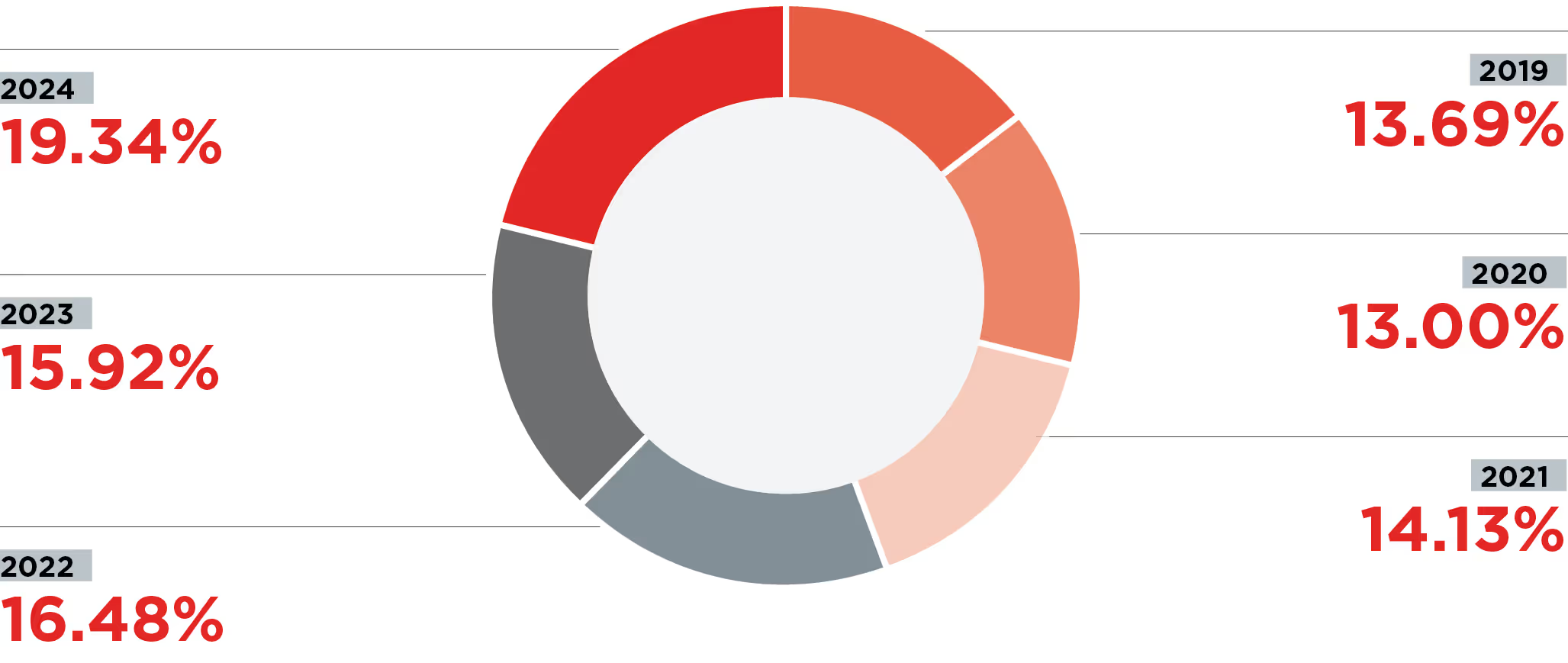

As of December 31, 2024, the share of Ziraat Bank in Türkiye’s foreign trade volume has been recorded as 19.34%.

When comparing the data for the years 2023 and 2024, it has been revealed that the country’s exports increased by 2%, while the exports mediated by the Bank has risen by 12%. As of the end of the year, Ziraat Bank’s share in mediation in the country’s export volume stood at 23.2%.

Ziraat Bank mainly provided support to contracting companies and exporters in 2024, issuing more than 1,400 external letters of guarantee worth approximately USD 3.6 billion and more than 330 letters of guarantee based on another bank’s counter-guarantee, worth approximately USD 250 million.

Within the framework of the special limits granted to Ziraat Bank by the Central Bank of the Republic of Türkiye (CBRT), more than 3,000 CBRT discount loans worth approximately TL 41 billion were extended in 2024, with mediation in the exports of approximately 1,900 companies. The Bank’s CBRT Rediscount Loan balance stood at approximately TL 46 billion as of year-end 2024.

According to figures for the sector published by the BRSA and in Independent Audit Reports in 2024, Ziraat Bank commanded 17.2% share in Türkiye’s total letter of credit volume as of December 31, 2024, with Ziraat Bank ranking first in the sector with its letter of credit share.

In 2024, the Foreign Trade menus of Ziraat Bank’s Internet Branch and Mobile Banking applications experienced significant usage by customers. During this period, over 250,000 transactions were conducted in areas including foreign currency transfers, cash and cash against goods import transfers, issuance and monitoring of Import Letters of Credit (ILCs), querying and monitoring of foreign trade files, and tracking transfers using Swift GPI.

These transactions not only reduced the intensity of transaction in branches by directing customers to non-branch channels, but also ensured high levels of customer satisfaction.

Ziraat Bank Country Foreign Trade Share by Year

Foreign Trade Volumes

Swipe right to view the rest of the table.

| (USD Billion) | 2023 | 2024 | Change (%) |

|

Country Imports |

362 |

344 |

-5% |

|

Ziraat Bank Import |

44 |

56.4 |

28% |

|

Country Export |

256 |

261 |

2% |

|

Ziraat Bank Export |

54 |

60.7 |

12% |

|

Country Total |

618 |

605 |

-2% |

|

Ziraat Bank Total |

98 |

117 |

19% |

|

Foreign Trade Share (%) |

15.92 |

19.34 |

Ziraat Bank-Türkiye Foreign Trade Volume Comparison (USD Billion)

Swipe right to view the rest of the table.

| Türkiye | Ziraat Bank | |

|

2021 |

426 |

70 |

|

2022 |

516 |

101 |

|

2023 |

520 |

98 |

|

2024 |

605 |

117 |

Sustainability-themed syndication loan received by a Bank in the country featuring the widest participation at a single time

Having undertaken an important mission in Türkiye’s sustainable development in line with its responsible banking approach, Ziraat Bank extended the most widely participated sustainability-themed syndication loan received by any bank in our country at a single time in 2024.

This loan, totaling USD 1.7 billion (comprising USD 742 million and EUR 884 million), has a maturity of 367 days and was backed by the participation of 21 new banks from 7 countries, alongside strong interest from 70 banks across 32 countries. The loan’s performance criterion focuses on financing sustainable agriculture. As part of this initiative, Ziraat Bank intends to use the funds from the syndication loan not only to support foreign trade but also to promote sustainable agricultural practices in line with its core mission.

Continuous support for foreign trade and the economy through foreign financing, facilitated by the securitization of remittance flows

Under the Diversified Payments Rights (DPR) securitization program established in 2023, Ziraat Bank issued a total of USD 250 million in June 2024, with a maturity of 10 years and a grace period of 4 years. This program is structured around USD-denominated remittances related to goods and services, exports, tourism, capital inflows, and individual transfers. The issuances were executed in two separate tranches in collaboration with international investor institutions.

In 2024, the Bank further enhanced its robust funding structure through new partnerships, while continuing to provide alternative financing sources, including bilateral loans and post-financing from correspondent banks, in addition to the Syndication loan and DPR program. As of the end of 2024, the Bank has had oversight on a balance of USD 2 billion secured through bilateral loans and post-financing from correspondent banks.

Rising synergies with Ziraat Finance Group

Ziraat Finance Group’s (ZFG) share of the global foreign trade volume is growing every year in line with Ziraat Bank’s strategy and vision to increase the effectiveness of its foreign partnerships and branches in the countries where they operate and to contribute to the development of commercial and economic relations between these countries and Türkiye. In 2024, the development of foreign trade among the countries where ZFG operates remained a strategic priority for the Bank, as it has always been.

Reliable correspondent bank limit allocation model

The creditworthiness of domestic and foreign correspondent banks is updated with analysis carried out periodically, with limits allocated in favor of these institutions using the internal rating model.

Strategies committed to the diversification of sources incapital markets

Ziraat Bank aims to diversify its sources of funding and provide cost-effective, long-term funding. As of April 3, 2024, the Bank’s Global Medium Term Notes (GMTN) program, originally amounting to USD 7 billion, has been updated to reflect an increased program limit of USD 13 billion, effective November 2024, to facilitate borrowing from international capital markets.

In the international markets, the Bank issued USD 500 million sustainability bond with a maturity of 5 years on January 16, 2024, and USD 500 million in subordinated bonds with a maturity of 10 years, featuring a call option at the end of the 5th year, on April 30, 2024. Additionally, the Bank continued to enhance its external funding through private placement issuances totaling USD 4.7 billion under the GMTN program in 2024.

Ziraat Bank’s projects carried out in the field of International Banking in 2024

Visa B2B

Within the framework of the protocol signed with Visa, the “Visa B2B Connect” payment platform covering business-to-business transfers for legal entity customers in international commercial payments was launched. Ziraat Bank was among the first banks to provide Visa B2B Connect service, a blockchain-based secure payment platform that is fast, transparent, and allows costs to be predicted in advance.

Ziraat Bank’s corporate internet branch and corporate mobile banking customers were allowed to make transfers to companies located in a total of 37 countries in Asia, the Far East, North Africa and Europe, regardless of whether the recipient’s bank is a Visa B2B member or not, in US dollars, Euros, and British Pounds, subject to the customers’ designated internet banking transaction limits and irrespective of the transfer amount.

Swift GPI (Overseas Transfer Tracking)

The Swift GPI Inbound Transfer Tracking application, which monitors the stages of the international fees expected by customers before they are transferred to the account, was launched in all channels. Providing customers with the opportunity to track the cost in real time, the application enables them to obtain information about future money transfers in advance and to make cash flow and payment planning. Internet Branch and Mobile Branch users, as well as customers using Corporate Monitoring in Internet Banking, can track the amount of the transfer in the Incoming Transfer Monitoring area under the Foreign Trade and International Transfers menu, and can also access information on its stage and whether correspondent banks charge any fees.

Swift GO

Swift GO, an innovative product standing out with its affordable costs in international money transfers, was integrated into the Bank’s systems. All customers using the internet branch and mobile application were enabled to make their payments between EUR 10 and EUR 10,000 to Swift GO member banks (except import transactions of legal entity customers) as a net payment to the recipient.

Export Tracking

With the improvements made in Internet Banking, exporter customers are now able to easily track their Export Customs Declarations and export prices, with the Bank acting as an intermediary, and to issue Export Price Acceptance Certificate (EPAC). The “Open Export Account Tracking” performed in accordance with the CBRT Export Circular is now carried out through Internet Banking.