Value for Our Country

I

Retail Banking

Number of Retail Banking Customers

45 Million

Consumer Loans

89.7 Billion

As the bank with the largest branch network in Türkiye, Ziraat Bank effectively delivers its products and services to customers while upholding its mission as the nation’s leading bank that meets individuals’ financial requirements throughout their entire life cycle, from education through their working years and into retirement.

In addition to its extensive physical service network spread across the country, the Bank also makes extensive use of alternative distribution channels to reach its customers with its ever-renewed and developing technological infrastructure. The Bank provides uninterrupted access to all products and services available under the Retail Banking umbrella through digital channels.

Providing services to all natural persons in need of financing, the Bank acquired 2.7 million new retail customers in 2024. With a total of over 45 million customers in retail banking, the Bank is one of the leading players in the sector.

Ziraat Bank continues to develop and offer the functions that its customers will need in consumer loan and overdraft account transactions on its digital channels.

In 2024, the Easy Limit application, which combines Overdraft Account (ODA), Credit Card, and Consumer Loan/Vehicle Loan products, was launched in order to easily meet customers’ individual credit requirements. The installment ODA product was initially launched through the branch channel and was then activated through digital channels within a short period. The Bank introduced the Digital Shopping Loan application to its customers. Ziraat Bank, which holds the largest market share in housing loans, continued to support its customers in their endeavors to become homeowners. In this context, housing loan allocations gained momentum with the interest rate cut in housing loans in the last quarter of 2024.

Retail loan products supporting energy efficiency:

The Energy Efficiency Management Loan

is extended to Apartment/Site Managements to finance investments made to increase the energy efficiency of buildings. Within the scope of green transformation and sustainability, a total of TL 170,899 was extended to 5 people.

The Individual Energy Efficiency Loan

is extended to our customers to finance their individual energy efficiency investments. Within the scope of green transformation and sustainability, a total of TL 1,509,400 was extended to 16 people.

The Green Housing Loan

is extended for energy-efficient houses in addition to our existing housing loan program in order to contribute to increasing the number of energy-efficient houses in our country. Within the scope of green transformation and sustainability, a total of TL 59,325,198 was extended to 231 people.

The Green Vehicle Loan

extended for brand-new vehicles with a proforma/final invoice and for 2nd hand vehicles with the phrase “electric or hybrid” on their vehicle license. Within the scope of green transformation and sustainability, a total of TL 605,990,894 was extended to 1,935 people.

The Bank launched a vehicle loan specific to TOGG, Türkiye’s national motor vehicle, extending TL 6.4 billion of loans to 8,894 customers.

Growth in Personal Loans

In 2024, Ziraat Bank maintained its share in the retail loans sector, which constitutes a significant part of its loan portfolio.

Ziraat Bank extended TL 22.5 billion in loans in 2024 through the products it offers within the scope of housing finance, and the Bank’s housing loan portfolio had reached TL 110 billion as of year-end.

Extending TL 89.7 billion of consumer loans in 2024, Ziraat Bank’s consumer loan balance ended the year at TL 74.7 billion. The Bank also extended TL 5 billion in vehicle loans, increasing its total vehicle loan balance to TL 8.3 billion at the end of the year.

A total of TL 21.6 billion was paid to 2.6 million pensioners within the scope of the new term promotion application for customers who chose to receive their pensions from Ziraat Bank.

Products Promoting Savings

Ziraat Bank continues to market the State Subsidized Dowry (Çeyiz) and the State Subsidized Housing Account products set out in legislation drawn up by the Ministry of Family, Labor and Social Services and the Ministry of Treasury and Finance to promote savings among the general public. The balance of the Dowry Account reached TL 43.9 million for 1,160 customers, and the Housing Account reached TL 24.3 million for 216 customers. After 3 years of regular payments, the state contribution applications of customers are submitted to the Ministries, and the state contribution is credited to the accounts of eligible customers.

The decline in Currency Protected Deposit (CPC) products, which were introduced to meet customer requirements sensitive to exchange rate fluctuations, to prevent customers who make their investments in Turkish Lira from being adversely affected by exchange rate risk, and to prevent them from being victimized by exchange rate volatility, continues.

Launched in February 2023, the Uninterrupted Time Deposit product provides customers with the convenience of being able to withdraw money whenever they need it without loss of maturity while increasing their savings. Real entity customers are entitled to open the account in TL terms with maturities of between 32-364 days. The Uninterrupted Time Deposit product reached a balance of TL 6 billion for 14,989 customers.

In addition, the Advantageous Time Deposit Account product, which was launched in December 2024, enables customers to earn additional interest with their expenditures and payments. With the Advantageous Time Deposit Account, as in the Uninterrupted Time Deposit Account, funds can be withdrawn on days other than the maturity date without disrupting the account’s term.

Currency Protected Deposit (CPD) products data:

Swipe right to view the rest of the table.

| CPD Converted from FC | YUVAM Account | FATSİ | Grand Total | ||||

|

Number of Accounts |

Balance |

Number of Accounts |

Balance |

Number of Accounts |

Balance |

Number of Accounts |

Balance |

|

98,490 |

151.8 |

33,612 |

95.03 |

1,751 |

1.9 |

133,853 |

248.7 |

Insurance Activities

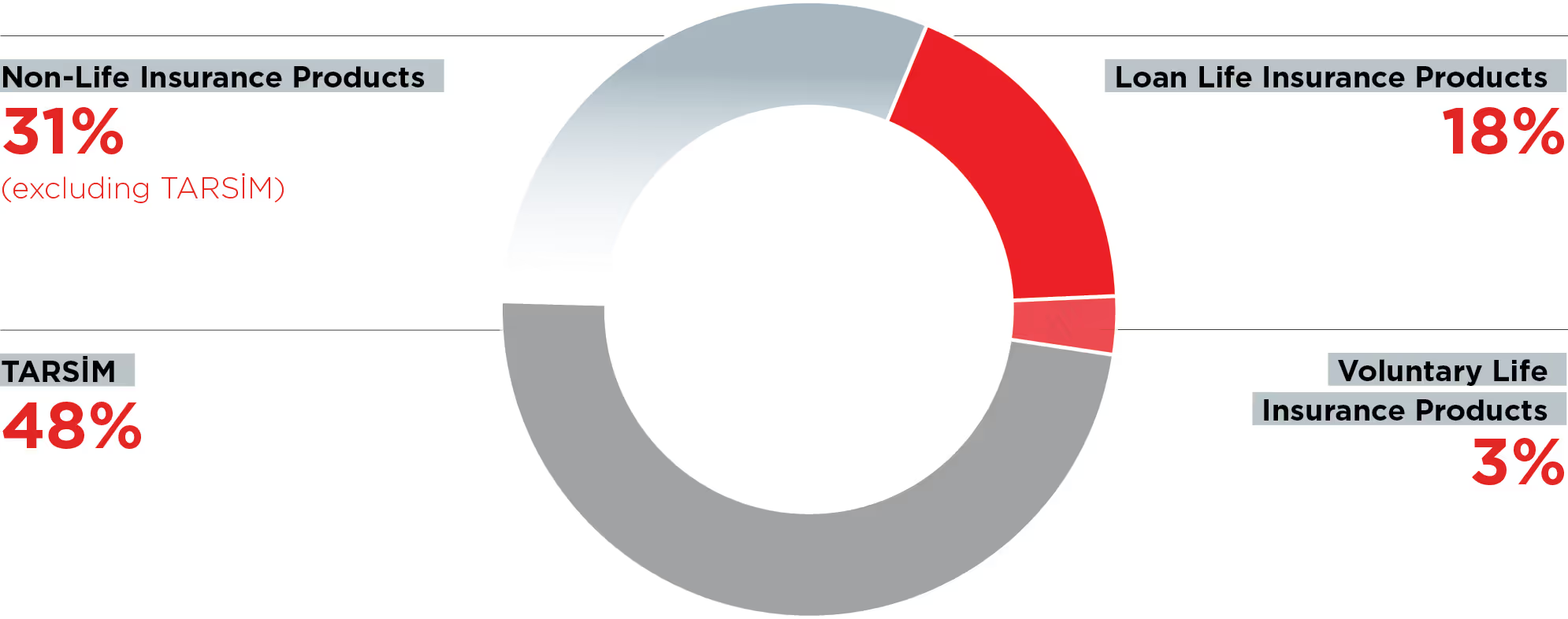

Ziraat Bank, while carrying out insurance activities as an agency with “Türkiye Sigorta A.Ş.” and “Türkiye Hayat ve Emeklilik A.Ş.,” has also concluded agreements with “Türkiye Katılım Sigorta A.Ş.” and “Türkiye Katılım Hayat A.Ş.” in 2024. It currently continues its agency activities with these four insurance companies. In this context, the Bank offers its customers Voluntary Life Insurance, Private Pension Plans (PPS), Health Insurance, Personal Accident, Engineering and other Non-Life insurance products, especially loan-linked Life Insurance, Housing Insurance, Compulsory Earthquake Insurance (TCIP), Motor Own Damage Insurance, Traffic Insurance, and TARSİM products.

In order to ensure that customers meet their insurance requirements easily and quickly, Ziraat Bank is working to increase the variety of products offered, especially through digital channels.

Ziraat Bank issued a total of 9.4 million insurance policies in 2024. The total amount of premiums generated in this context amounted to TL 35.6 billion.

Ziraat Bank’s market share in TARSİM policies issued in the context of agricultural loans reached 61% in 2024.

The Bank recorded a 65% increase in premiums in 2024 compared to the previous year. Intermediating Private Pension transactions, Ziraat Bank generated a total volume of TL 8.7 billion in 2024.

Ziraat Bank’s commission income generated from insurance agency activities amounted to TL 6 billion as of December 31, 2024.

Kolay Kasa Transaction Volume

TL 10 Billion

Number of Companies Defined to Kolay Kasa Product

3,910

Other Insurance Activities Carried out by Ziraat Bank in 2024

Within the Non-Life Insurance Group, the following products were launched for sale: Credit Protection, My Passwords Are Secure, Credit Card Protection, State-Supported Receivables Insurance, Commercial Package Fire Insurance, My Bills Are Secure, Cyber Risk Protection, and I’m Ready for Anything Insurance.

In the Life Insurance Group, Life on a Good Day and Life Insurance with Premium Refund were offered to customers.

The PPS for My Farmer plan, with special advantages for agricultural customers, was launched.

In addition to the Death coverage, the Accidental Disability and Illness Disability coverages were added to life insurance policies associated with consumer, housing, and vehicle loans.

Effective Cash Management Practices

Ziraat Bank intermediates in invoice and other payments with hundreds of contracted organizations, and offers its customers the ability to carry out their payments through ATMs, Internet Banking, Mobile Banking, and Automatic Payment channels in addition to the Bank branches. In 2024, 60.5 million tax collections amounting to TL 2,261 billion, 2.7 million customs duties amounting to TL 504.5 billion, 15.3 million SSI collections amounting to TL 1,105 billion, and 443.5 million other institutional collections amounting to TL 579.6 billion were carried out from contracted institutions through the Corporate Collection System.

In addition, the Bank continues to offer customized payments, magnetic cheques/notes, accounting integrations, pool accounts, and cash collection services to meet the requirements of its customers.

The Kolay Kasa product, a cash management service which enables stores, branches and dealers to deposit their cash generated during the day directly from ATMs to the company’s main account free of charge, both quickly and practically without the need for any intermediary, reached a total of 3,910 defined companies and 54,266 sub-companies with a total transaction volume of TL 10 billion as of year-end 2024.

Number of Taxes Paid Through Corporate Collection System

TL 60.5 Million

Amount of Taxes Paid Through Corporate Collection System

TL 2,261 Billion

2025 and Beyond

Offering a wide range of products to meet all financial requirements and expectations of individual customers, Ziraat Bank aims to continue providing services to its customers with the right value proposition. It aims to become a Bank inspiring the banking sector with its innovative product and service designs.

In 2025, within this scope, it is planned

To increase the variety of retail loan products offered through digital channels and the quality of service in these channels, and to direct customer preference to these channels,

To take action to deepen product ownership for existing retail customers, as well as to acquire customers who are not yet actively using the Bank’s services,

To manage customer preferences more actively by intensifying campaign activities,

To continue offering the Vehicle Loan product with a more advantageous interest rate in the financing of domestically produced vehicles compared to other vehicle loans due to its positive environmental impact and contribution to the national economy,

To continue offering retail loan products supporting energy efficiency.